Why Binomial Trees Still Matter in Real Markets

Most people meet options pricing through a single intimidating formula, then either memorize it or avoid it. At Resultant, we prefer tools that explain themselves. The binomial tree is one of those tools. It is not academic finance for its own sake; it is a practical way to think about uncertainty, step by step, the same way markets reveal themselves in real time.

The Intuition Behind Derivative Pricing

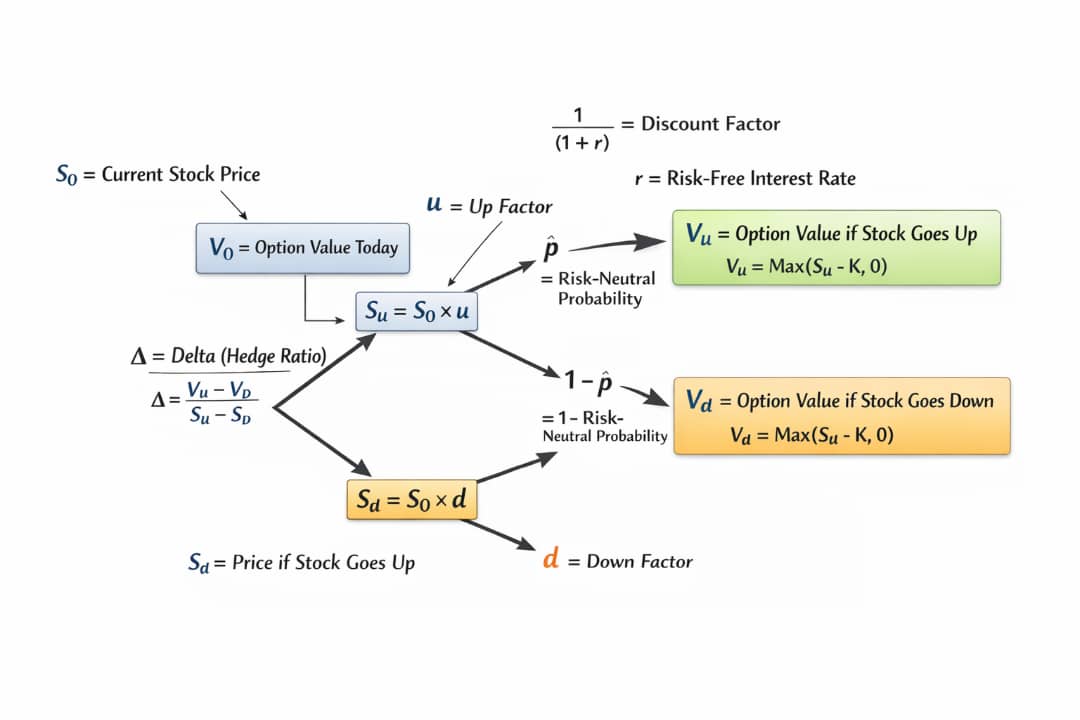

Derivative pricing is often misunderstood as forecasting. It is not. The core idea is replication. If you can build a portfolio of the underlying asset and cash, or borrowing, that produces the same payoff as an option, then the option’s fair price is the cost of that replicating portfolio.

This is where binomial trees become useful. They make replication visible. At each point in the tree, you solve for how many shares are needed and how much cash is required so that, regardless of whether the market moves up or down next, the portfolio matches the option payoff in that next step. Working backward from expiration to today removes guesswork and replaces it with structure.

This approach matters in major markets because liquidity can hide risk. Equities can reprice sharply around earnings. Commodities can move suddenly on supply shocks or geopolitical events. A binomial framework forces discipline by asking, at every step, what happens if the next move goes against you.

How This Thinking Shapes Resultant

We approach public markets with a holding company mindset. Every position is a capital allocation decision under uncertainty. Binomial trees align with this philosophy because they turn uncertainty into something that can be examined and managed.

They convert volatility into clearly defined scenarios. They make hedging a deliberate calculation rather than an instinctive reaction. Most importantly, they reinforce process over prediction. The framework does not respond to headlines or emotion. It responds to structure, probabilities, and payoff relationships.

As Resultant grows into private equity and venture capital, this mindset remains unchanged. The instruments may differ, but the principle is constant. Sustainable results come from understanding risk, structuring decisions carefully, and relying on repeatable processes rather than hope or noise.